Getty Images

Getty ImagesThe UK’s economy shrank unexpectedly in the lead up to the Budget, according to the latest official figures.

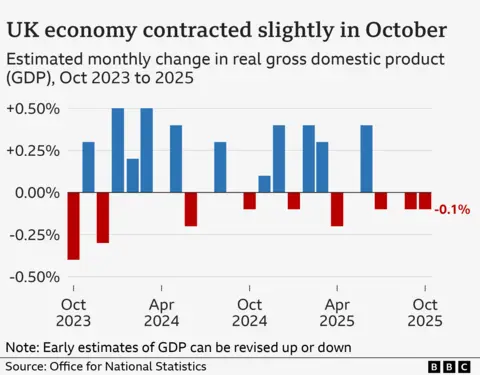

The economy contracted by 0.1% in October, the Office for National Statistics (ONS) said, whereas economists had been expecting it to grow by 0.1%. The economy also shrank by 0.1% in the three months to October.

The cyber-attack at Jaguar Land Rover continued to affect car production, with only a slight recovery in October from the previous month’s fall, while analysts said uncertainty ahead of the Budget had slowed consumer and business spending.

The weaker-than-expected figures strengthen the case for the Bank of England to cut interest rates at its meeting next week, analysts said.

The government has made economic growth one of its key priorities.

A Treasury spokesperson said the government was working to boost economic growth through reducing energy bills and major infrastructure investments.

“We are determined to defy the forecasts on growth and create good jobs, so everyone is better off, while also helping us invest in better public services,” the spokesperson said.

Shadow chancellor Sir Mel Stride blamed the Budget for the unexpected contraction, saying it was “a direct result of Labour’s economic mismanagement”.

“For months, Rachel Reeves has misled the British public. She said she wouldn’t raise taxes on working people – she broke that promise again. She insisted there was a black hole in the public finances – but there wasn’t.”

Ruth Gregory, deputy chief UK economist at Capital Economics, said the surprise contraction in the economy was “a further reason to expect the Bank of England to cut interest rates next Thursday.”

“It’s striking that the economy has only grown in one of the past seven months,” she said.

Over the three months to October, production output shrank by 0.5%, largely driven by a 17.7% fall in vehicle manufacturing.

The cyber-attack on Jaguar Land Rover halted production at its plants across the UK for the whole of September, and there was a staged return to factory activity from early October.

The resumption of vehicle manufacturing helped lift production output across the UK for that month, which grew by 1.1%.

However, the ONS noted the rebound in vehicle manufacturing had been small, as it was still well below levels seen in August.

The services sector, which makes up about three-quarters of the economy and includes areas such as professional services and retailing, did not grow at all in the three months to October.

The monthly GDP figures are more volatile than the rolling three-month data, which is considered to give a better underlying picture of growth.

But Jack Meaning, UK chief economist at Barclays bank and a former adviser at the Bank of England, told the BBC’s Today programme the latest figures showed the economy was “unambiguously weak”.

“It’s continuing the story we’ve seen more or less all the way through this year of growth decelerating from relatively strong numbers at the start to much weaker numbers now, and actually outright contraction,” he said.

“Ultimately part of the story today is that we didn’t see as much of a bounce-back of that Jaguar Land Rover closure as we had expected. We thought that would all bounce back pretty quickly; it looks like it might take a little bit longer.”

Mr Meaning added that data from Barclays indicated that the uncertainty ahead of the Budget weighed on the economy as people “held off purchases and big spending decisions”.

Scott Gardner, investment strategist at JP Morgan Personal Investing, said Budget speculation ahead of the chancellor’s speech “had a numbing effect” on spending.

“Budget speculation and uncertainty around potential tax changes dampened the mood among businesses and consumers, leading some to delay key decisions until the Budget had been delivered,” he said.

Fergus Jimenez-England, associate economist at the National Institute of Economic and Social Research, said the chancellor’s increase to her financial buffer in the Budget “should help reduce uncertainty over the coming year”, but it was unclear whether that would strengthen economic activity.

But KPMG UK’s chief economist Yael Selfin said investment from the private sector and government “could help foster growth over the coming year”.

“As a result, we expect investment to remain a key contributor to growth going into 2026,” she said.

Sign up for our Politics Essential newsletter to keep up with the inner workings of Westminster and beyond.